SurplusInterconnectionin Utah

Accelerating Clean Energy Deployment by Leveraging Existing Grid Infrastructure

Utah faces a capacity crunch as aging thermal plants retire and clean energy deployment lags

The Problem

Interconnection Delays

Utah has ~31 GW of active projects in PacifiCorp's interconnection queue (162 projects), with average connection timelines of 3-5 years—creating significant delays for new clean energy deployment.

Demand Doubling While Clean Energy Lags

Utah's Operation Gigawatt initiative aims to double electricity capacity in 10 years to meet surging demand from data centers and industrial growth. Yet thermal generation still dominates at 75% (coal 45%, gas 32%), while solar represents only 14%—and 31 GW of clean energy projects sit stuck in interconnection queues, unable to deploy quickly enough.

New Gas Supply Challenges

New gas plants ordered today won't come online until 2030-2031 at earliest, creating a critical gap in meeting near-term capacity needs. Additionally, capital costs have surged: recent combined-cycle projects now cost $2,000/kW or more, up from $1,116-1,427/kW for 2026-2027 projects, making new gas generation increasingly expensive.

Economic Opportunity Loss

Utah faces growing economic development constraints as electricity demand is projected to double in the next 10 years, driven by data centers, AI infrastructure, and industrial electrification. With power availability now the primary site selection factor for data centers, extended interconnection timelines and capacity constraints limit the state's competitiveness for these high-value investments.

The Solution: Surplus Interconnection

Surplus Interconnection for Utah

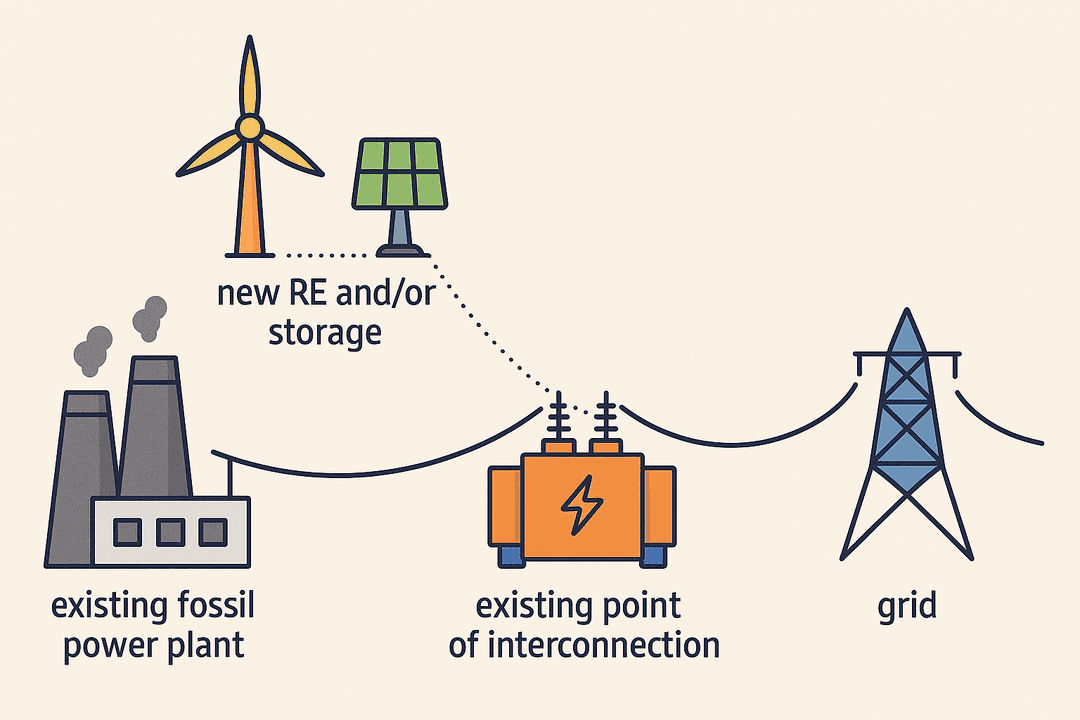

Surplus Interconnection Service allows new electricity supply resources to connect to the grid using existing infrastructure that serves already operating generators, without exceeding the total output capacity already allocated to the existing resource. FERC Order 845 (2018) cleared a regulatory pathway for generators to add new electricity resources to the grid by utilizing surplus capacity at existing interconnection points.

Key Results

Available Surplus Capacity

Utah can add up to 13 GW of additional clean capacity at existing Utah power-plant interconnections by 2030 using Surplus Interconnection—including ~7 GW at thermal sites and ~4 GW additional RE enabled by ~2.5 GW of 6-hour storage at existing renewable sites, without new greenfield transmission.

Firming Renewables

Storage-hybridization can lift effective capacity factors toward ~75% 'firm-like' service at selected sites. Solar potential with storage reaches ~65% and wind ~76%.

Time & Cost Benefits

Surplus interconnection projects can be completed in ~12-24 months compared to ~5-7 years for new gas plants. Utah's surplus interconnection deployment can save ~$1.1B in interconnection costs by leveraging existing infrastructure.

Thermal Interconnections

Utah's 7.6 GW thermal fleet shows significant underutilization. Peaker gas plants operate at 24.3% capacity factor and oil/gas steamers at 15.5%—meaning 1.4 GW operates at <30% capacity factor. Thermal plants have variable costs ranging from $30-83/MWh, creating economic opportunities for cheaper renewables. By co-locating solar and wind at these sites, we can bypass lengthy interconnection queues.

Key Results

Abundant Local Resources

175 GW Total156.2 GW solar and 18.7 GW wind potential within 6 miles of Utah thermal plants. Assessment applied 50+ exclusion criteria for physical and environmental constraints.

Urban Area Plants

Excluded from Analysis14 thermal facilities with 575 MW capacity are located in urban areas. We removed these plants from the surplus interconnection analysis though they are great candidates for adding battery storage after the thermal plants get retired.

Economic Crossover

7.6 GW by 2030By 2030, all 7.6 GW of Utah thermal capacity has variable costs higher than local solar LCOE. Solar beats entire fleet even without IRA tax credits.

Total RE Integration Potential

~7 GW by 2030~7 GW of total renewable energy can be economically integrated at Utah thermal plants by 2030 using existing grid connections and avoiding lengthy queue delays.

Quick Wins Available

1.4 GW Underutilized1.4 GW of thermal capacity operates at less than 30% capacity factor, leaving grid connections unused most of the time and creating immediate opportunities for surplus interconnection.

Renewable Interconnections

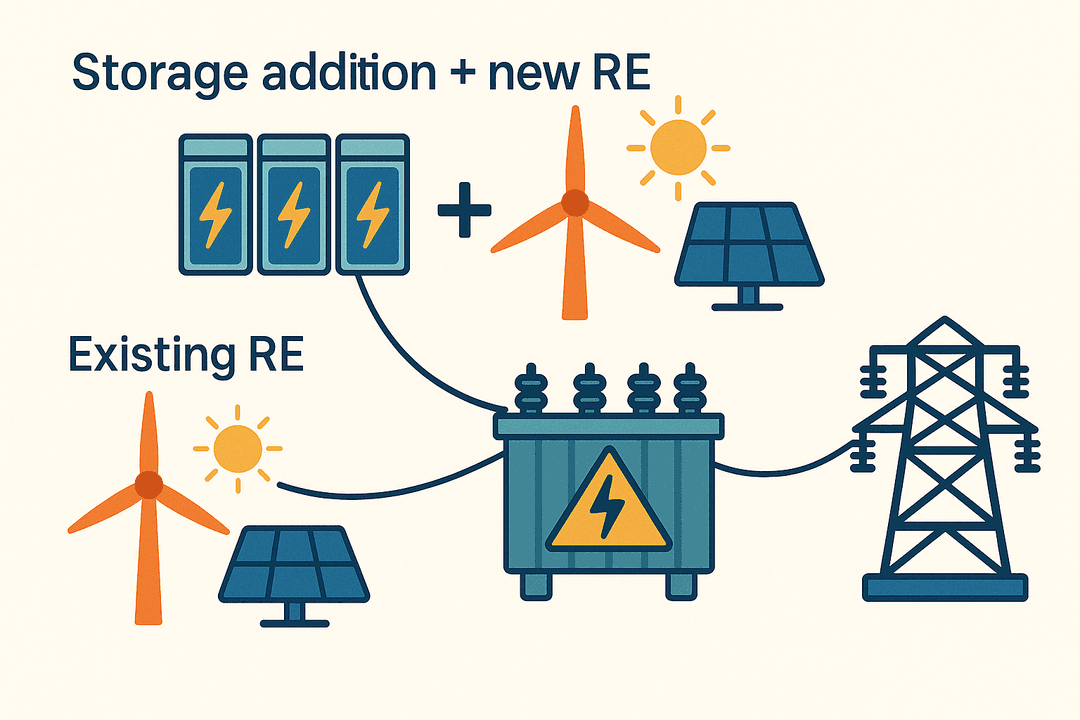

Utah's 2.5 GW of existing renewable capacity operates at low capacity factors—solar at 27.9% and wind at 22%—meaning interconnection capacity sits idle 72.1% and 78% of the time respectively. Adding approximately 2.5 GW of 6-hour battery storage can enable an additional ~4 GW of renewable capacity and dramatically increase capacity factors to 64.8% for solar and 76.8% for wind, effectively turning variable renewables into firm power resources.

Key Results

Additional RE Potential

179 GW Near RE Plants160.2 GW solar and 19.2 GW wind potential within 6 miles of existing renewable plants. Utah's 2.5 GW existing capacity (2.1 GW solar, 387 MW wind) provides foundation for expansion.

Storage Integration

~2.5 GW StorageAdding ~2.5 GW of 6-hour battery storage enables additional capacity while absorbing curtailment and shifting generation from midday to evening peaks.

Renewable Site Expansion

~4 GW | ~142% IncreaseUtah's existing renewable interconnections can support additional ~4 GW clean capacity when paired with 2.5 GW storage—~142% increase at those sites.

Firm Capacity Achievement

~75% CF | 64.8% Solar | 76.8% WindBattery-enabled plants can achieve ~75% capacity factors, with solar reaching 64.8% and wind 76.8% utilization—transforming intermittent resources into firm, dispatchable power.